pitchIN Secondary Trading Market (PSTX)

Read more on

Not an investor? Go to Issuers page

- How it works

- Learn more

- FAQ

Auto-matching Orders

What does an order refer to?

An order refers to a specific instruction given by an investor to buy or sell a specific number of shares, at a desired maximum or minimum price.

Orders are then placed on an Order Book, where they will be auto-matched if a corresponding buy or sell order is placed by another investor.

How do auto-matching orders work?

Orders are accepted on a first-to-takeup-bid basis - this is to ensure benefit to both buyers and sellers. All buy orders (bids) and sell orders (offers) are logged with their respective timestamps.

First, all orders are queued in the Order Book

- Buy orders are sorted by the highest price first. If two orders are at the same price, the earlier order will be higher in the queue.

- Sell orders are sorted by lowest price first. If two orders are at the same price, the earlier order will be higher in the queue.

Second, the orders are matched according to their position in the queue

- Buy orders will be matched if the price is equal to or higher than any existing sell orders. The execution price will be determined by the sell order.

- Next, sell orders will be matched if the price is equal to or lower than any existing buy orders. The execution price will be determined by the buy order.

- Orders may be partially matched. Any unmatched amount will continue to remain on the Order Book, ready to be matched.

Important Reminder

When placing an order before the market opens a.k.a pre-market order, buy orders will be auto-matched with sell orders, done at the sell price. Hence, the execution price will be determined by the sell order, until the pre-market buy orders are cleared.

In other words, when the market opens on Wednesday at 10:00 a.m., bids that are equal to or higher than existing offers will be matched to offers by price, and then time priority at the offer (sell) price. To repeat: Matching is done at the sell price.

Example: Place Buy Order for Existing Sell Order

- There are existing sell orders at various prices in the Order Book. You wish to buy 15 shares at a maximum of RM12.00 per share.

- Your order will be matched with the lowest-priced shares until it fulfils your order volume. In this case: 10 @ RM10.00 and 5 @ RM11.00.

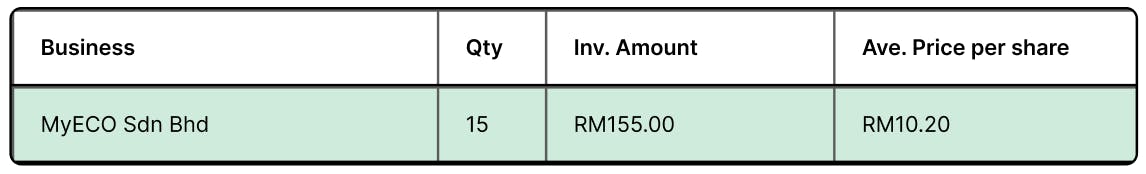

- Outcome:

- You now own 15 shares totalling RM155.00 (excluding trading fees)

- Your average price per share is RM10.20

- The order is fully matched and cleared from the Order Book

- Your shares are now visible on your portfolio

Before order match

Order book: you entered a buy order, with existing sell orders

Portfolio: you don’t currently own any shares

After order match

Order book: your buy order is cleared, because it has been fully matched

Portfolio: you now own 15 shares

Example: Place Buy Order during Pre-Market Hours

- Before the market opens, there are existing buy & sell orders at various prices on the Order Book.

- You wish to buy 20 shares at a maximum of RM15.00 per share & are positioned at the top of the Order Book due to your bid price being the highest.

- Once the market opens, your order will be matched first with the lowest-priced shares, in this case: 15 @ RM11.00 and 5 @ RM11.50.

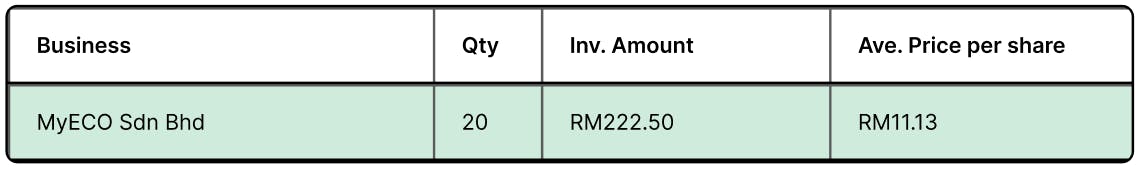

- Outcome

- You now own 20 shares totalling RM222.50 (excluding trading fees)

- Your average price per share is RM11.13

- The order is fully matched and cleared from the Order Book

- Your shares are now visible on your portfolio

Before market opens

Order book: your order is at the top of the queue because it’s the current highest bid

Portfolio: you don’t currently own any shares

After market opens and your order matched

Order book: your order is cleared, because it has been fully matched

Portfolio: you now own 20 shares

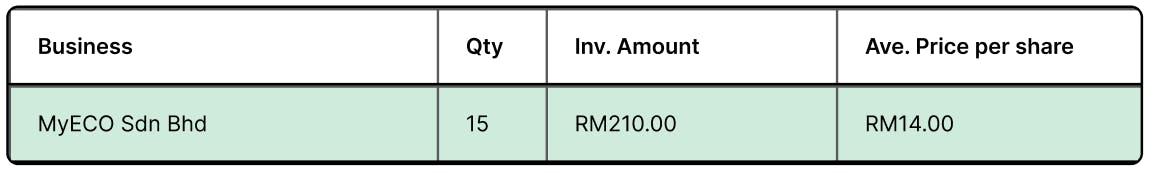

Example: Place Buy Order in a blank Order Book

- You wish to buy 20 shares at a maximum of RM15.00 per share. However, there are presently no sell orders on the Order Book.

- Upon waiting, a new sell order for 15 shares is opened. Your order will be matched at 15 @ RM15.00, your buy order price.

- Outcome

- You now own 15 shares totalling RM225.00 (excluding trading fees)

- Your average price per share is RM15.00

- The order is partially matched, with 5 shares still unmatched. This will remain on the Order Book for future matches, until Friday at 10:00 p.m. (Order Book Reset)

- Your shares are now visible on your portfolio

Before order match

Order book: you entered a buy order in a blank Order Book (no existing sell orders)

Portfolio: you don’t currently own any shares

After order match

Order book: your have 5 unmatched share remaining on the Order Book

Portfolio: you now own 15 shares

How do I know if my Buy Order is successful?

When orders are fully matched, the transactions are settled immediately by crediting your balances in your PSTX Account. In the case of a partial match, your PSTX Account will only be debited/credited when the order is cancelled or closed on Friday 10:00 p.m. This is to ensure you’re only charged the trading fee once.

All transactions will be reflected in your Portfolio records immediately, and you will also be issued a Digital Share Certificate to indicate share ownership.

Note that if the shares you purchased are held directly by the Seller (and therefore, not under Pitch Nominee), a change in shareholding to Pitch Nominees Sdn Bhd must be reflected in SSM before the transaction can be marked as complete. There is, however, no indication before a match that the shares being sold are held by a direct shareholder. During the transfer process, you may notice that the shares you purchased are marked as 'Untradable'. This indicates that the shares cannot be traded, and the corresponding amount is held in your PSTX Account.

The Digital Share Certificate will only be issued post-successful SSM registration, and the aforementioned shares can only be traded thereafter.